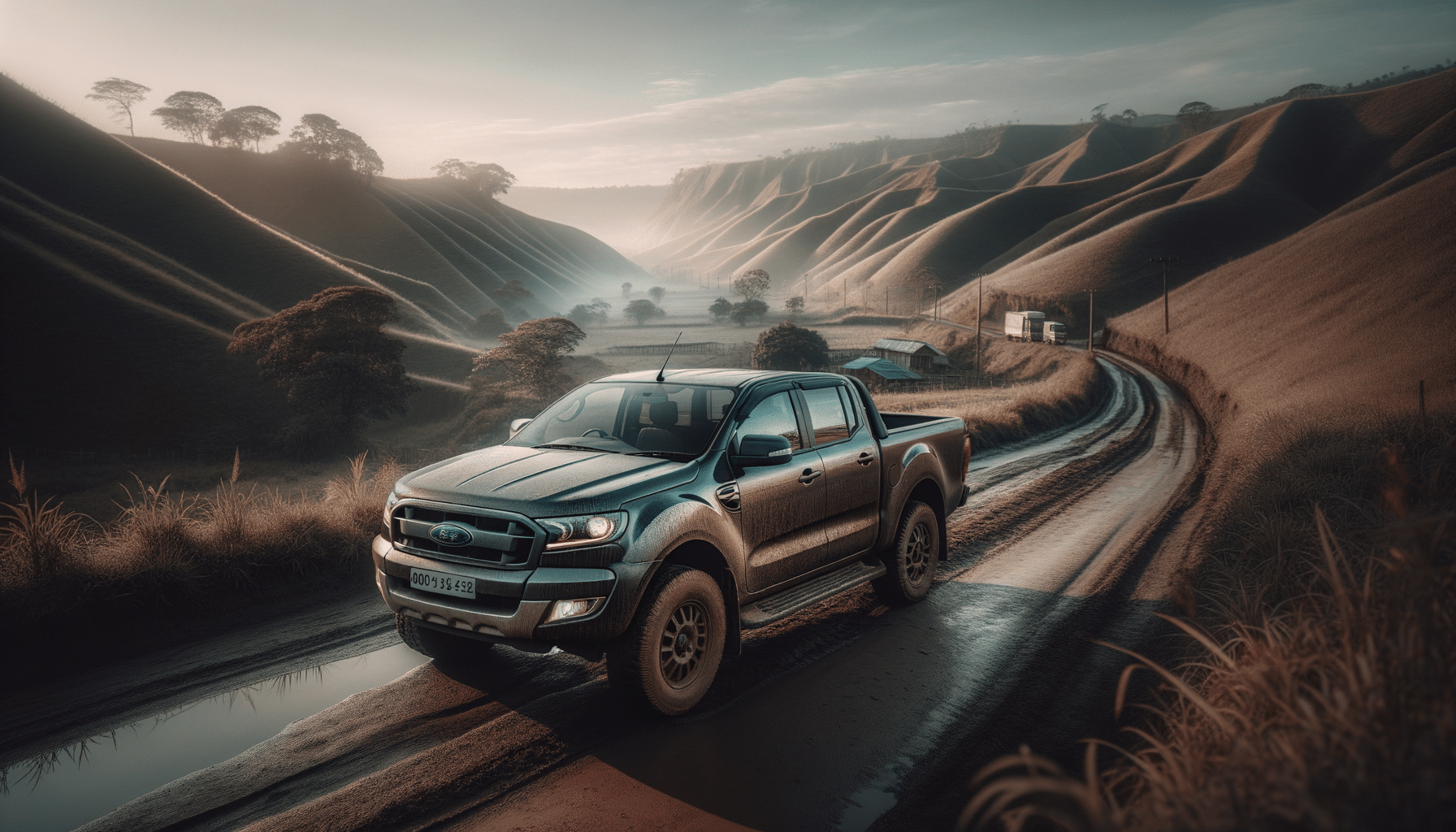

Explore Rent to Own Pick Up Trucks for Flexible Options

Introduction to Rent to Own Pick Up Trucks

In today’s dynamic automotive market, rent to own pick up trucks provide an appealing option for those seeking flexibility and convenience. This innovative approach allows individuals to drive a truck while gradually working towards ownership. Rent to own agreements are particularly beneficial for those who may not qualify for traditional financing or prefer not to commit to a long-term loan. By understanding the intricacies of rent to own arrangements, potential buyers can make informed decisions that align with their financial and lifestyle needs.

Benefits of Rent to Own Pick Up Trucks

Rent to own pick up trucks offer numerous advantages that cater to a diverse range of consumers. One significant benefit is the ability to drive a vehicle without the immediate need for a large down payment. This can be particularly advantageous for individuals who are building their credit or managing other financial obligations. Additionally, rent to own agreements often include maintenance and repair services, reducing the worry of unexpected expenses.

Moreover, rent to own options provide flexibility, as they allow consumers to test the vehicle over time and decide if it truly meets their needs before committing to purchase. This trial period can be invaluable for those unsure about their long-term vehicle requirements. With these agreements, there is also the potential to negotiate terms, such as payment schedules and final purchase price, offering a more personalized buying experience.

How Rent to Own Agreements Work

Understanding the mechanics of rent to own agreements is crucial for anyone considering this option. Typically, these agreements involve a contract between the consumer and a dealership or private seller. The consumer pays a monthly fee, which generally covers both the rental cost and a portion that contributes towards the eventual purchase of the truck. At the end of the agreed rental period, the consumer has the option to buy the vehicle outright, often at a predetermined price.

It’s important for consumers to carefully review the terms of any rent to own contract, paying particular attention to details such as the length of the rental period, monthly payment amounts, and conditions for vehicle maintenance. Additionally, potential buyers should confirm whether the agreement includes any mileage restrictions or penalties for early termination. By thoroughly understanding these elements, consumers can avoid potential pitfalls and enjoy a seamless transition to vehicle ownership.

Comparing Rent to Own with Traditional Financing

When deciding between rent to own and traditional financing, consumers should consider several factors. Traditional financing typically involves securing a loan through a bank or financial institution, requiring a credit check and often a sizable down payment. In contrast, rent to own arrangements may offer more accessible terms for individuals with less-than-perfect credit.

However, it’s worth noting that while rent to own can be more flexible, the overall cost may be higher compared to traditional financing due to potentially higher interest rates and fees. Consumers should perform a cost comparison and consider their long-term financial goals before making a decision. Additionally, individuals who anticipate significant changes in their financial situation may prefer the flexibility of a rent to own agreement over a fixed loan.

Conclusion: Is Rent to Own Right for You?

Rent to own pick up trucks present a viable option for those seeking flexibility and a path to ownership without the constraints of traditional financing. By carefully evaluating the benefits and potential drawbacks, consumers can determine if this option aligns with their financial goals and lifestyle needs. Whether you’re looking to improve your credit, test drive your dream truck, or avoid a long-term commitment, rent to own could be the solution you’ve been searching for.