Explore Personal Loans for Financial Planning Options

Introduction to Personal Loans

In today’s dynamic financial landscape, personal loans have become a pivotal tool for many individuals seeking to manage their finances effectively. Unlike other forms of credit, personal loans offer a flexible solution, catering to various financial needs, from consolidating debt to funding major life events. Understanding personal loans is crucial for anyone looking to harness their potential for better financial planning.

Personal loans are unsecured, meaning they don’t require collateral, making them accessible to a broader audience. This accessibility, combined with fixed interest rates and predictable monthly payments, makes personal loans an attractive option for those aiming to streamline their financial obligations. As we delve deeper into the world of personal loans, we’ll explore their benefits, potential drawbacks, application processes, and how they can be leveraged for financial growth.

Benefits of Personal Loans

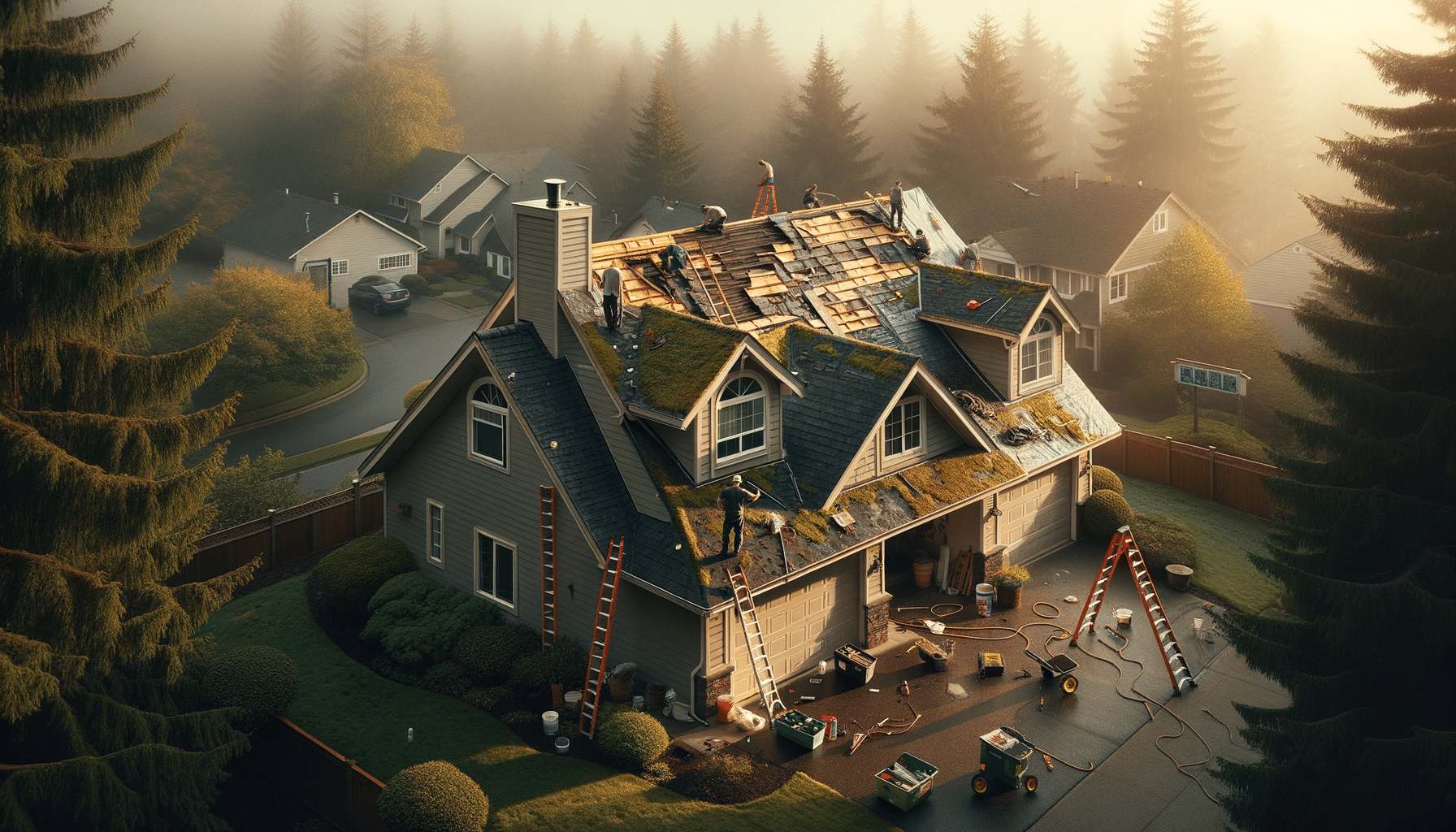

One of the key advantages of personal loans is their versatility. Whether you’re looking to consolidate high-interest debt, fund a home renovation, or cover unexpected medical expenses, personal loans provide a lump sum of money that can be used for virtually any purpose. This flexibility is particularly beneficial for borrowers who need to address multiple financial needs simultaneously.

Another significant benefit is the predictable nature of personal loans. With fixed interest rates, borrowers can enjoy consistent monthly payments, making budgeting more straightforward. This predictability can be a relief for those who have struggled with fluctuating credit card payments or variable interest loans. Furthermore, personal loans often come with lower interest rates compared to credit cards, especially for borrowers with good credit scores.

Personal loans can also positively impact your credit score. By consolidating debt and making timely payments, borrowers can improve their credit utilization ratio and payment history, which are critical components of a healthy credit score. This improvement can open doors to better financial opportunities in the future.

Potential Drawbacks of Personal Loans

While personal loans offer numerous benefits, it’s essential to be aware of potential drawbacks. One of the primary concerns is the fixed repayment term. Unlike credit cards, which allow for flexible repayment schedules, personal loans require borrowers to adhere to a set repayment plan. This rigidity can be challenging for individuals whose financial situations fluctuate.

Additionally, personal loans may come with origination fees and prepayment penalties. Origination fees are typically a percentage of the loan amount, which can add to the overall cost of borrowing. Prepayment penalties, on the other hand, may apply if you decide to pay off the loan early, negating some of the interest savings you might expect.

Borrowers should also consider the impact of taking on additional debt. While personal loans can help manage existing financial obligations, they also increase your overall debt load. It’s crucial to assess your financial situation and ensure that taking on a personal loan aligns with your long-term financial goals.

The Application Process for Personal Loans

Applying for a personal loan is a relatively straightforward process, but it requires careful preparation. The first step is to assess your financial needs and determine the loan amount that aligns with your objectives. Once you’ve established your loan requirements, it’s essential to review your credit score, as it plays a significant role in determining your eligibility and interest rate.

When you’re ready to apply, you’ll need to gather necessary documentation, such as proof of income, identification, and any other financial information the lender requires. Most lenders offer online applications, making it convenient to submit your details from the comfort of your home.

After submitting your application, the lender will evaluate your creditworthiness and financial situation. This assessment involves reviewing your credit score, income, debt-to-income ratio, and other factors. If approved, you’ll receive the loan terms, including the interest rate and repayment schedule, which you can review before accepting the loan.

Leveraging Personal Loans for Financial Growth

Personal loans can be a strategic tool for achieving financial growth when used wisely. One effective strategy is using a personal loan to consolidate high-interest debt. By doing so, you can reduce your overall interest expenses and simplify your monthly payments, freeing up cash flow for other financial goals.

Another approach is to invest in your education or career development. A personal loan can fund courses, certifications, or training programs that enhance your skills and improve your earning potential. This investment in yourself can yield significant returns over time, both professionally and financially.

Lastly, personal loans can be used to finance home improvements that increase your property’s value. By enhancing your living space, you not only improve your quality of life but also potentially boost your home’s resale value, leading to long-term financial gains.

In conclusion, personal loans offer a range of benefits that can be leveraged for financial growth. By understanding their advantages and potential drawbacks, you can make informed decisions that align with your financial goals and aspirations.