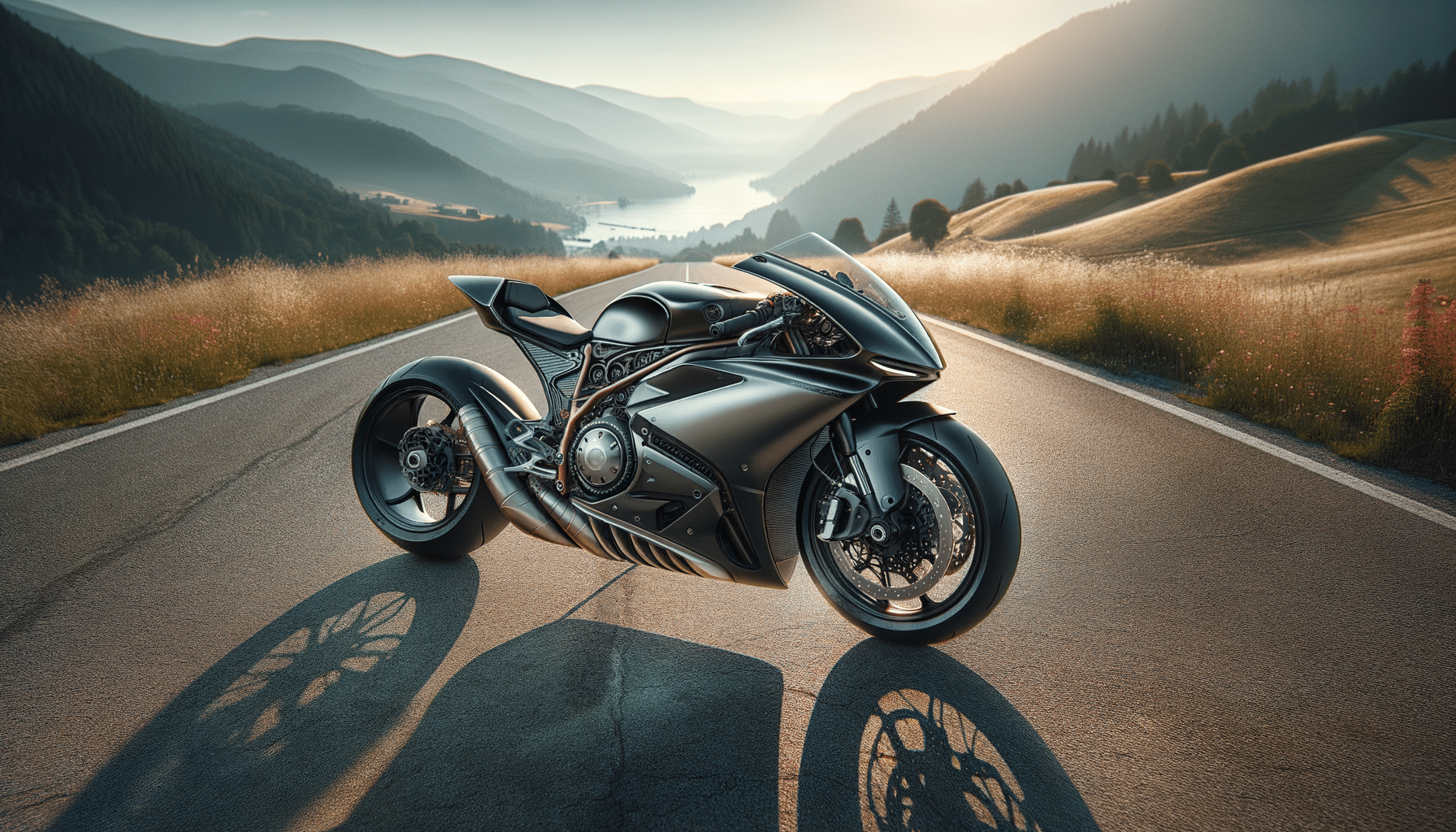

Explore Motorcycle Loan Options for Financing Possibilities

Introduction to Motorcycle Loans

Motorcycles are more than just a mode of transportation; they represent freedom, adventure, and a connection to the road that few other vehicles can offer. However, purchasing a motorcycle often requires a significant financial commitment. This is where motorcycle loans come into play, offering a viable solution for enthusiasts looking to own their dream bike without draining their savings. In this article, we will delve into the various aspects of motorcycle loans, helping you understand their significance and how they can be tailored to suit your financial needs.

Understanding the Basics of Motorcycle Loans

Motorcycle loans are specialized financial products designed to help individuals purchase motorcycles. These loans can be obtained from banks, credit unions, or online lenders, each offering different terms and conditions. The primary advantage of a motorcycle loan is that it allows you to spread the cost of the bike over a period of time, making it more affordable.

When considering a motorcycle loan, it is essential to understand the key components, such as the interest rate, loan term, and monthly payment. Interest rates can vary significantly based on factors such as your credit score and the lender’s policies. Typically, better credit scores result in lower interest rates. Loan terms can range from one to seven years, with longer terms resulting in lower monthly payments but potentially higher overall interest costs. It’s crucial to evaluate your financial situation and choose a loan term that aligns with your budget.

Moreover, motorcycle loans may come with different repayment options, including fixed or variable interest rates. Fixed rates provide stability with predictable monthly payments, while variable rates might start lower but can fluctuate over time. Carefully considering these options will ensure that you select a loan that best fits your financial circumstances.

Comparing Loan Providers

When searching for a motorcycle loan, it’s important to compare offers from various lenders to find the most suitable option. Banks, credit unions, and online lenders each have their pros and cons. Banks often offer competitive rates for those with excellent credit but may have stricter approval criteria. Credit unions, on the other hand, might provide more personalized service and flexible terms, especially for members.

Online lenders have gained popularity due to their convenience and quick approval processes. These lenders often cater to a wider range of credit profiles, making them an attractive option for those with less-than-perfect credit scores. However, it’s essential to research the reputation and reliability of online lenders before proceeding.

When comparing loan offers, pay attention to the annual percentage rate (APR), which includes both the interest rate and any fees associated with the loan. A lower APR generally means lower overall costs. Additionally, consider any prepayment penalties or other fees that could impact the total cost of the loan.

Tips for Securing a Favorable Motorcycle Loan

Securing a favorable motorcycle loan requires careful preparation and attention to detail. Start by checking your credit score and addressing any discrepancies or areas for improvement. A higher credit score can significantly impact the interest rate you are offered, potentially saving you a substantial amount over the life of the loan.

Next, determine a realistic budget for your motorcycle purchase, factoring in not just the cost of the bike but also insurance, maintenance, and any additional gear you may need. Having a clear budget in mind will help you avoid overextending yourself financially.

Consider making a larger down payment if possible, as this can reduce the loan amount needed and result in lower monthly payments. Additionally, shop around and negotiate with lenders to secure the most favorable terms. Don’t hesitate to ask questions and seek clarity on any aspect of the loan agreement that you don’t understand fully.

Conclusion: Making an Informed Decision

Motorcycle loans offer a practical solution for financing your motorcycle purchase, allowing you to enjoy the thrill of riding without the immediate financial burden. By understanding the intricacies of motorcycle loans, comparing different lenders, and following best practices for securing favorable terms, you can make an informed decision that aligns with your financial goals.

Remember, the key to a successful motorcycle loan experience is thorough research and careful planning. Whether you’re a seasoned rider looking to upgrade or a newcomer eager to experience the open road, a well-structured motorcycle loan can help make your dreams a reality.